I have always wanted to put together some figures to see what has been happening to total government expenditure. It was clear at the start of the coalition government that what started as a government which was really quite tight as to finance developed into a government with some financial flexibility. At the time I knew that was because the interest rates on government debt were coming down which freed up money to be spent.

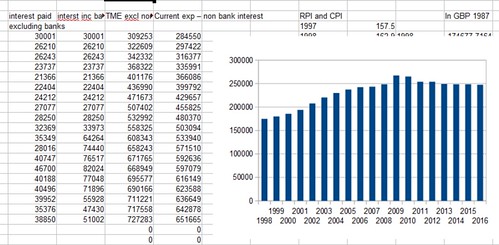

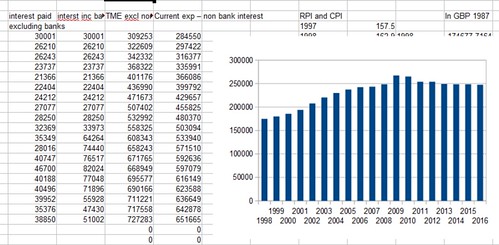

I have spent a little time getting at the statistics from the ONS to try to see what actually has happened actually since 1998. In the chart below I have taken the ONS figures for spending in the calendar year. That is because the inflation figures (RPI/CPI) are also calendar year figures. In the end a similar pattern would arise with financial year figures. What I have taken is the current spending excluding banks and calculated that in 1987 Equivalent Pounds sterling. When copying the image from my source data I have left the source figures both for current spending and also for interest on government debt. What I find interesting about the interest on government debt is that it has done down since 2011 although the amount of debt has gone up. Obviously it will continue going up now as the more expensive debt has been rolled over into a lower interest rate.

The key thing to note, however, is that current public spending in real terms has been higher in real terms during austerity than any year prior to 2008.

I have spent a little time getting at the statistics from the ONS to try to see what actually has happened actually since 1998. In the chart below I have taken the ONS figures for spending in the calendar year. That is because the inflation figures (RPI/CPI) are also calendar year figures. In the end a similar pattern would arise with financial year figures. What I have taken is the current spending excluding banks and calculated that in 1987 Equivalent Pounds sterling. When copying the image from my source data I have left the source figures both for current spending and also for interest on government debt. What I find interesting about the interest on government debt is that it has done down since 2011 although the amount of debt has gone up. Obviously it will continue going up now as the more expensive debt has been rolled over into a lower interest rate.

The key thing to note, however, is that current public spending in real terms has been higher in real terms during austerity than any year prior to 2008.

Comments