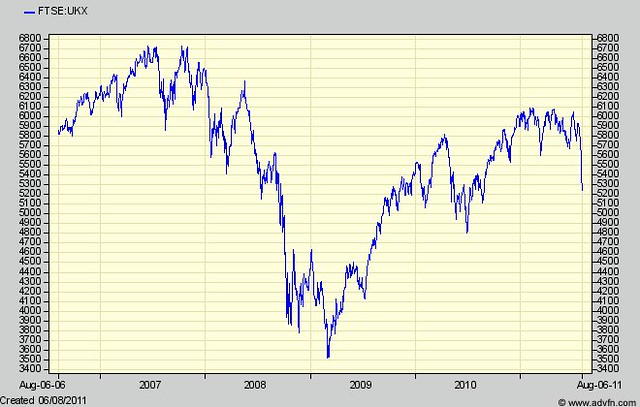

This is always the test of chart readers.

There is obviously an international element to the recent market movements. There is also recognition that even the US cannot simply fund demand on increasing debt.

I think there is also an August over-reaction as a result of many people being on holiday and people closing out positions. However, to hazard a guess I would not expect the market to go below the 2010 low.

I may, of course, be wrong. A goodly amount of weekend doomsaying could push the market lower. I think there is a 40% chance of bottoming out below the 2010 figure, but I am with a 60% chance of it bottoming out above that.

I think, however, that Labour's whinging about the government's policy of managing the deficit (too much too quickly) is now essentially proven to be wrong.

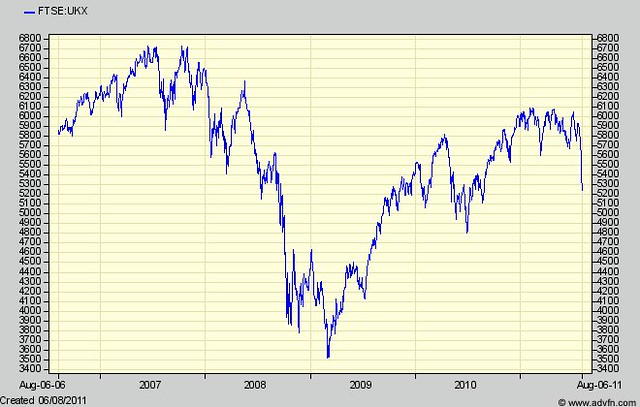

There is obviously an international element to the recent market movements. There is also recognition that even the US cannot simply fund demand on increasing debt.

I think there is also an August over-reaction as a result of many people being on holiday and people closing out positions. However, to hazard a guess I would not expect the market to go below the 2010 low.

I may, of course, be wrong. A goodly amount of weekend doomsaying could push the market lower. I think there is a 40% chance of bottoming out below the 2010 figure, but I am with a 60% chance of it bottoming out above that.

I think, however, that Labour's whinging about the government's policy of managing the deficit (too much too quickly) is now essentially proven to be wrong.

Comments